As the airline industry responds to the need to find new revenue, it is about to be swept ahead in a tidal wave of digitalisation that is linked to how society as a whole has found new and preferable solutions with the possibilities of technology.

The massive social changes of the 2020 pandemic have triggered the promotion of digital retail, commerce and communications into being the default way of doing things, and airlines will have to follow suit.

An end-to-end passenger experience

The most obvious opportunity for revenue growth is to broaden the scope and uptake of retail services to passengers. The entry point to convert passengers into customers has been in the lead-up to flying and when they are in the aircraft.

But what is to stop airlines retailing services before and after the journey? And once they do that, they are in the position to offer any service, at any time. This approach can be encapsulated as passenger-engagement-as-a-service. The technology is there, it’s just the mindset and strategies that need to adapt.

Leisure travel to rebound first

New business models will be vital because when the post-pandemic recovery kicks in it is unlikely that air travel will return to 2019 norms. The International Air Transport Association’s latest forecast is that it will not start until the latter part of 2021. As the pandemic subsides, leisure trips are predicted to outpace the recovery of business travel, according to management consultants McKinsey & Company in an April 2021 insights report.

McKinsey estimates that business travel will only likely recover to around 80% of pre-pandemic levels by 2024, while others are more downbeat. Bill Gates, the Microsoft founder, believes half of all business travel will go away when talking with the World Economic Forum. All of which suggests that unbundling journey options and traditional trolley services will not counter revenue shortfalls.

Providing a portal onboard

The groundwork for revitalising onboard retail got going before coronavirus hit, as airlines began offering wireless inflight entertainment (W-IFE) in response to passengers bringing their own devices on board. The hygiene concerns of 2020 further motivated airlines to replace paper menus and magazines with digital incarnations accessed on passengers’ smart devices.

Noting that the growth of W-IFE has remained robust in the face of COVID-19, Valour Consultancy calls it the “foundation for airlines to exit the stone age, radically transform their operations and exploit much-needed new ancillary revenue opportunities”. It also observes that, with paper media relegated to the past, “the ‘E’ in ‘IFE’ is rapidly becoming less about entertainment in the traditional sense of the word and more about maximising engagement with passengers”.

Eastern Airlines, a US carrier, has a clear ambition to improve passenger experience and generate new cross-platform opportunities, according to CEO Steve Harfst. The airline is preparing to install a W-IFE solution from AirFi on its first two B777 aircraft after nearing rollout completion on its B767 fleet at the end of April 2021. This will be followed by launching a new buy-on-board catalogue for passengers to shop food, beverages and comfort items via the browser on their smart devices.

“Ancillary revenue is an important part of our strategy and allowing our team members to collect these fees and charges more effectively using AirFi will continue to be vital to our growth. Digitising online sales significantly streamlines ancillary revenue,” says Harfst.

New partnerships onboard

A flurry of partnerships across the IFE connectivity sector, e-commerce technologists and onboard service specialists is enabling airlines to offer passengers richer on-demand services.

For example, Immfly is partnering with booking platform GetYourGuide to enable passengers to book on-the-ground experiences while flying, even if the aircraft is out of range of internet connectivity. Immfly is also collaborating with Tourvest Retail Services to integrate a touchless omni-channel retail proposition with an advanced connected cabin digital services and entertainment platform.

- Watch a webinar featuring Immfly, Get Your Guide and Boeing about unlocking Ancillary Revenue

Bluebox Aviation Systems meanwhile is teaming up with both Retail inMotion and dnata Catering to sell meals and other products via Bluebox’s W-IFE solutions.

“It’s probably one of the most striking market observations coming out of the pandemic actually – the shift from the service enhancement proposition of offering W-IFE onboard to IFE being seen and deployed as a revenue-generator,” says Kevin Clark, Bluebox CEO.

The importance of onboard WiFi

Intranet W-IFE allows airlines to get going with digital in-flight services and sales and can help them prepare for and make the business case for full connectivity. “Airlines should consider using the service to engage their passengers and learn about their preferences and digital behaviours,” says Clark. “They need to ensure that the service is ‘sticky’ – keeping passengers coming back for the benefits they gain from engaging with the service.”

He observes: “Passenger preferences and behaviours will generate considerable data, which will offer insight not only to anticipate products to have available on board, but also open up opportunities for retail partnerships on the ground, which is turn can offer greater revenue generation opportunities for the airline.”

According to Michael Raasch, CEO, Omnevo, the next evolution for inflight retail and ancillary revenue will come as airlines get to grips with both their digital and future business strategies. “Airlines will have a huge opportunity with their retail and e-commerce stores to create lifestyle brands. That’s what’s going to happen next,” he says.

Raasch’s vision for the airline as lifestyle brand includes a curated product range and sub-categories or concept stores under this umbrella. For him, what will differentiate airlines from Amazon and the like will be their ability to leverage their loyalty programmes, which provide a ready-made customer base as well as a virtual currency in the form of loyalty points or miles.

Understanding how e-commerce works to create a flexible and intuitive shopping experience will be critical according to Raasch. “If you go on a website where you want to buy something and it becomes a painful experience…you do it once and then you are lost…This is what airlines don’t understand, you have missed that opportunity if you mess it up. If it works well then it becomes very powerful.”

The integration of software and operational processes across airlines and their technology, retail and catering partners will be another challenge. “Every catering operation, every carrier has their unique set up and processes,” explains Raasch.

Omnevo’s solution is to provide plug and play modules that can be adapted as the retail operation matures. This modular approach is underway in its partnership with dnata to support Air Arabia’s onboard retail business.

Creating brand loyalty

A sense of how airlines are evolving can be gained from looking at retail innovation among some carriers based in Asia. In April, low cost carrier AirAsia, which already offers grocery shopping and restaurant meal delivery, extended its reach into beauty products and financial services.

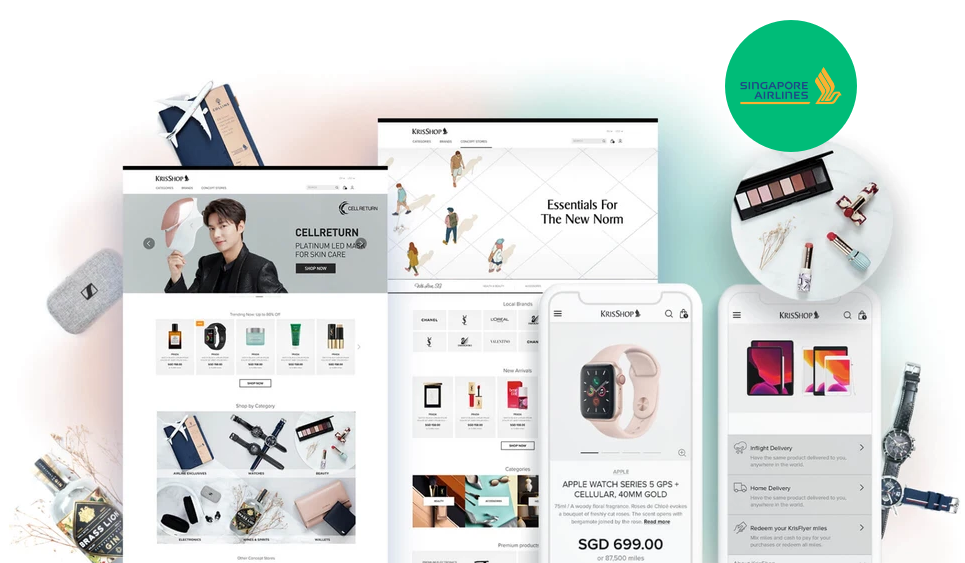

And last autumn, Singapore Airlines (SIA) rolled out its Kris+ app that combines payment, lifestyle and rewards services on one platform. Kris+ works with over 150 partners in Singapore and, since January 2021, with overseas merchants as well, and gives SIA the ability to personalise offers to its global customer base, via interest- or location-based recommendations. Customers will then earn miles from their everyday spend or pay for purchases with their miles.

“Our vision is to create a comprehensive and updated lifestyle and payments ecosystem with Kris+. This will offer even more and better options and benefits for our global customer base, and bring additional value to our partners around the world,” says JoAnn Tan, Acting Senior Vice President of Marketing Planning.

Joined up thinking is needed to move forward

There is a sobering truth underlying these changes: the industry in general is being held back by anachronistic thinking that belongs to a bygone era. Siloed concepts such as in-flight entertainment, ancillary revenue, and in-flight services are still common business parlance. Rather, we should be looking at the global arena of passenger engagement-as-a-service, any time, any place. The flight should be perceived as an integral part of that service offering and not as an encompassing entity that sets the boundary to our ambitions.

Related articles

- Personalised Special Diets Onboard: The Rise of Hyper-Customised Meal Options

- Asia Trends at WTCE: How dnata Catering & Retail is leading a culinary revolution

- What is healthy anyway? Why does comfort food have to be pitched against nutritious food when flying?