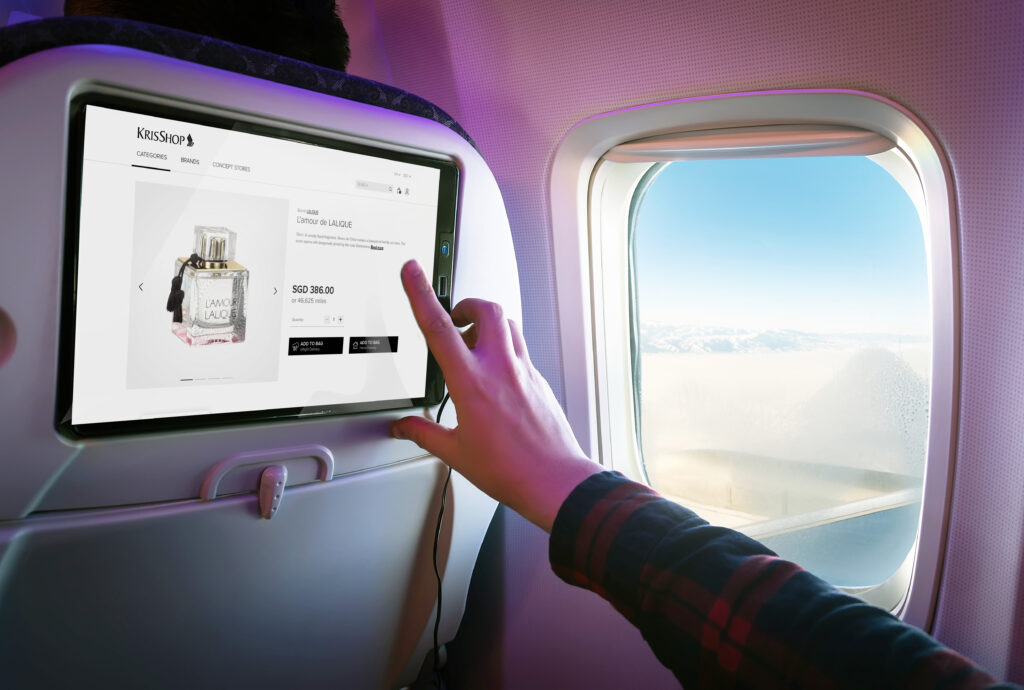

The burgeoning shift to in-seat ordering offers a potentially game-changing opportunity for low-cost and full-service carriers alike. Airlines will seek to extend their engagement with passengers with the introduction of in-seat ordering, either via the passenger’s own mobile device or the seat-back screen.

These digital ancillary sales are expected to reach US$29 billion within the next seven years. Just as important will be the opportunity to extend their branded offers and to remain a trusted source of ancillary services for travellers, even after they disembark and continue on their journey.

Most consumers already see their mobiles as all-purpose devices to manage their lives — and their travel. The ability to order meals and refreshments that suit their tastes and budgets, as well as shop onboard, in a time frame that works for them, is a definite enhancement to their inflight experience. It is an opportunity to personalise their journey and, just as significant, it gives them some agency at a time when they may be restricted to their seats for several hours.

The digital buy-on-board opportunity

Air travellers are increasingly younger and technically literate so a fast uptake of digitalised buy-on-board services should be a reasonable expectation. Valour Consultancy’s report The Market for Onboard Ancillary Revenues and Payment Solutions — 2023, predicts that revenue generated via inflight entertainment and connectivity systems (IFEC) will account for 95% of all onboard purchases by 2031 — up from 15% percent in 2022.

The remaining 5% will come from manual trolley services. Valour also projects that IFEC-driven ancillary revenues are poised to reach US$29bn by 2031. In contrast, at the end of 2021 and the height of the pandemic, onboard airline ancillary revenues were estimated to be US$4.4bn.

The report’s author, Alex Preston, explains: “In addition to an increase in passenger traffic, and more aircraft returning to service, digitalisation within the cabin has bought to the fore smarter, customer-centric and more integrated platforms, often with connectivity at their core, hosting a range of sales-led, commercial opportunities, that are delivered to a seat back screen or passenger’s electronic device.”

He continues: “This has come at the expense of the trolley service (manual sales) for both food and beverages and duty free. For example, food and beverage sales from trolley services will see a sharp decline from US$1.9bn in 2021 to US$710 million by 2031 as more in-seat ordering is adopted.

Total manual ancillary revenues (those generated purely from the trolley service) are expected to fall from US$3.6bn in 2021 to US$1.6bn by 2031, due to a sharp decline in the popularity and availability of the trolley service, as well as continued adoption of connectivity throughout aircraft cabins.”

The dilemma for inflight services decision makers is that it will take some time for ubiquitous full-bandwidth connectivity to the seat to be rolled out across the global fleet while the need to evolve buy-on-board strategies and enhance passenger experience remains.

Another Valour report, The Future of In-Flight Connectivity – 2023, forecasts that there will be more than 22,000 IFC-equipped aircraft by 2032. According to projections from both lessor Avolon and the Oliver Wyman management consultancy, the worldwide commercial aviation fleet will be over 36,000 aircraft by this stage. (In 2023, the total fleet amounted to 27,400 aircraft according to Oliver Wyman). Meanwhile, online shopping in the terrestrial space has evolved into an efficient and reliable machine that has set customer expectations.

Preparing for connectivity

However, the lack of full connectivity need not be a show stopper as in-cabin solutions that provide a local connection within the aircraft are being rolled out. These address the requirement to provide a digital buy-on-board experience, enabling passengers to shop and order meals and snacks from the onboard services to their seat using their mobile devices.

Whatever onboard processes airlines design, they need to be “full-connectivity-ready” out of the box, in order to remain relevant when full connectivity finally arrives. Any airline that needs to redesign, re-task and retrain once connectivity becomes competitively available will be at a significant disadvantage. Meanwhile, local connection systems can be a powerful enabler for evolving the onboard digital experience.

Catherine Brown, Head of Marketing at Bluebox Aviation Systems, a specialist in creating value-generating digital platforms, says: “We believe that onboard retail as a stand-alone solution – specifically on its own or deployed separately but coexisting with embedded IFE systems – will prove an accelerator in the evolution of digital onboard experience.”

She adds that offering a stand-alone retail solution not only provides airlines with a proof-of-concept opportunity for delivering a digital experience to passengers’ own devices, it also off-sets its own investment with the revenue it generates and can be implemented in an offline environment.

Revenue generated via inflight entertainment and connectivity systems (IFEC) will account for 95% of all onboard purchases by 2031.

Valour Consultancy’s predictions in The Market for Onboard Ancillary Revenues and Payment Solutions — 2023

With the maturity of consumer mobile technology, airlines do not need to reinvent everything themselves. “Technology and aviation interiors work to different timescales,” declares Jo Rowan, Associate Director at multidisciplinary design agency PriestmanGoode. “The planning and build of an aircraft interior and its length of service is very different to the lifecycle of a personal electronic device.”

“I think it is also a case of knowing your strengths and points of differentiation,” she notes. “Is it really worth investing in a system for a cabin that a technology company has already mastered and is already a feature on a personal device that a customer will bring on board? Wouldn’t it be better to integrate that and focus on other aspects of the passenger experience?”

Once full-connectivity is available onboard, the issue will be to ensure that the connected passenger remains engaged within the airline’s brand experience and that their virtual presence is not taken elsewhere.

Michael Raasch, CEO of digital travel retail solutions provider Omnevo, observes: “Improved connectivity, such as high-quality Wi-Fi with solutions like Starlink, opens possibilities for e-commerce providers like Amazon and booking platforms such as Booking.com to be competing with travel retail as we know it. This would be a comprehensive enhancement in the inflight digital experience and airlines should be preparing their offerings to compete in these scenarios.”

Compete is the operative word here because, as Bluebox’s Brown notes, losing passenger attention to third-party shopping providers and social media is lost revenue and engagement for airlines. She says: “What airline wishes to completely concede the onboard digital engagement and ultimately the relationship with the passenger? You have them onboard – engage them, invite them to buy things with offers unique to you and your brand partnerships.”

Turning passengers into customers

Given that a digital retail experience, with real-time updates and transactions supported by connectivity, has “almost limitless potential” according to Brown, where should you start? What are the key areas of untapped potential worth investigating?

Rowan at PriestmanGoode points out that “Meal services, retail, streaming and gaming are big opportunities where we know passengers could be willing to pay for a better experience.” But she adds there is an opportunity in the cabin itself that has received less attention – virtual or digital branding.

“The investment in branded elements onboard an aircraft is significant – and brands change more frequently than the lifetime of the physical structures of the cabin. Digital branding through lighting, projections and other media is an area that has not been fully explored.”

Another area of untapped potential is offering services to support the passenger’s whole journey by selling complementary products, otherwise known as cross-selling. Some complementary products may be sold in an off-line environment, but the opportunity becomes even greater once connectivity is in the mix.

Jon Harwood, Vice President – Retail Services, dnata Catering, says: “Greater cross-selling is the area of most untapped potential and the way the industry is going, and our focus is on supporting airlines in offering services across the entire customer journey.”

Omnevo’s Raasch also highlights the “vast” opportunity to use data tools such as AI for predictive loading and personalisation to enhance passenger choice and service, as well as boost sales and reduce waste. For him, the key area of untapped potential is the powerful data sets available to airlines and harnessing them effectively.

He says: “Smarter utilisation of data can enable more detailed personalisation as algorithms accumulate information. Untapped potential also extends to loyalty programs and data sharing among airlines and alliances. Integrating loyalty programs at all touchpoints, engaging in brand cooperation, and exploring data-sharing agreements can significantly enhance the passenger experience and loyalty.”

Evolving to a digitalised business model

Realising these opportunities will demand business model and process changes. Raasch says: “Digitalisation prompts airlines to reconsider customer expectations, streamline purchase processes and explore innovative revenue streams. This transition involves adapting logistics and inventory management to ensure a smoother and more efficient buy-on-board experience.” He adds: “Ultimately, the digitalisation of onboard services demands a re-evaluation of how airlines approach inflight retail offerings.”

Business model evolution must also consider how passengers and crew are impacted, and moving to digital retail is already offering benefits to both. Brown at Blubox says: “Our experience shows that when passengers are able to place an order when they want to, not just have to wait for the trolley, more sales are made. A digital retail service helps meet demand that was hidden by the constrained pattern of a trolley service.” She adds “Fulfilling ad hoc orders may be a big departure from managing scheduled trolley services; digital retail also presents new ways to incentivise cabin crew.”

Across the aviation business integrating legacy and siloed systems has long been a thorny problem and the issue is also present in the onboard environment. Raasch notes that cautious adoption of new technologies and careful management of alliances can also be barriers for airlines. He says: “The industry can better support airlines by facilitating the integration of new technologies, addressing legacy system complexities, and promoting collaboration within alliances to ensure a smoother journey in their onboard digital services transformation and beyond.”

Achieving a step change in onboard digital retail will require industry-wide accepted methodologies and protocols so that any partner in the cabin experience delivery can communicate with, and utilise, the connected digital retail systems. It demands a collaborative effort in order to face off competition from external disruptors.

Collaboration not just between airlines and their technology and industry services partners, but also across their alliances and brand partnerships. Broader more holistic relationships will not only support the digital evolution, they will also position airlines to have greater resilience.

The other inference here is that a significant change is about to occur in the relationship between airlines and their passengers. The traveller will become more of a full-service customer whose needs can be met by the range of branded onboard offers. That itself infers a realignment of the airline business model.

This article was produced in paid partnership with Gillian Jenner.